Blank online

financing

up to 3,000,000 ₸

Blank online

financing up

to 3,000,000 ₸

«Wakala Zaman»

Agency Deposit

up to 20%

«Wakala Zaman»

Agency Deposit

up to 20%

The first Islamic

digital card

The first Islamic

digital card

up to 20%

with Islamic principles

up to 3 million ₸

by the Shariah Supervisory Board

transfers

No extra fees

digital card

ready for online payments

Enter your details

to calculate the payment

earned under the financing agreement

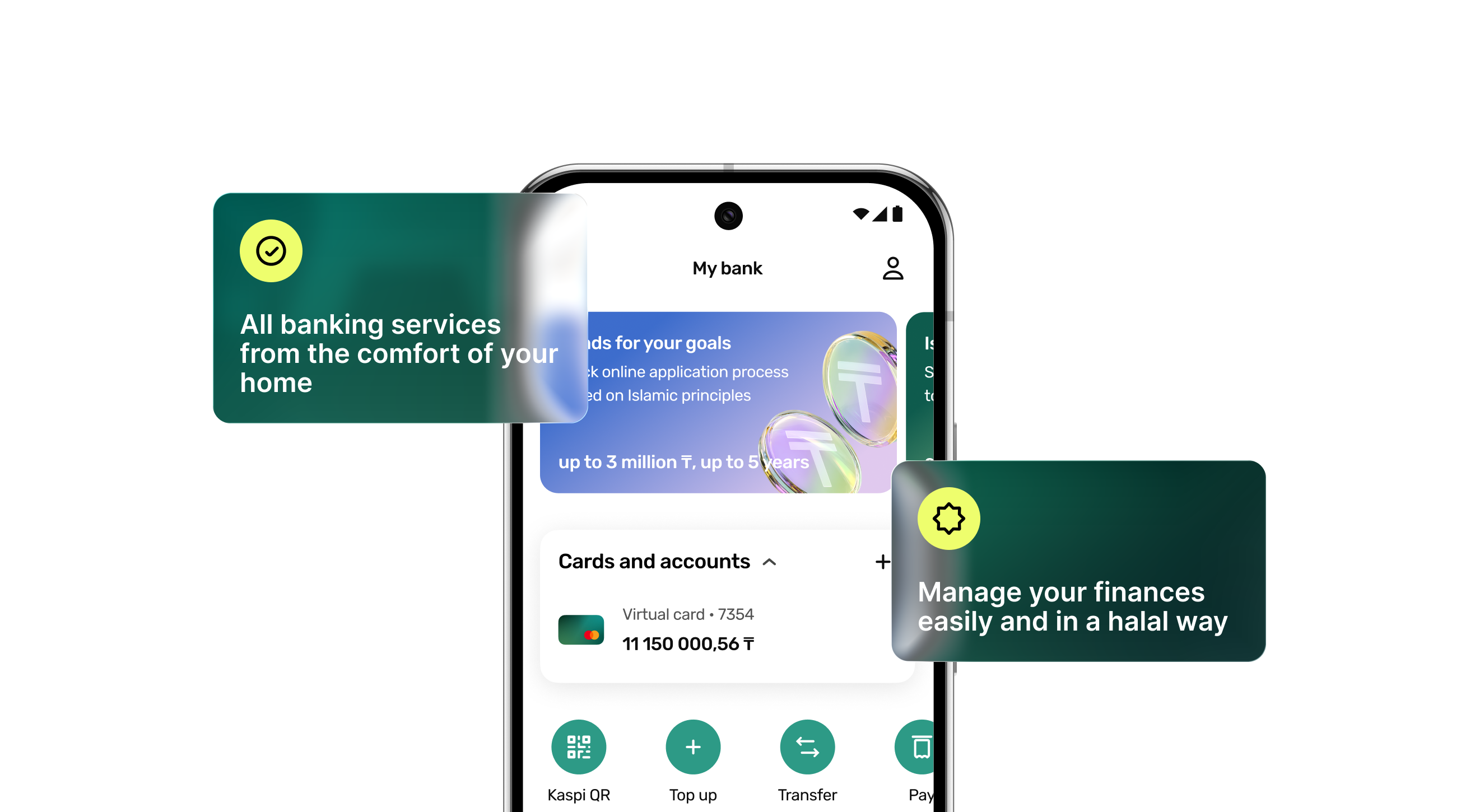

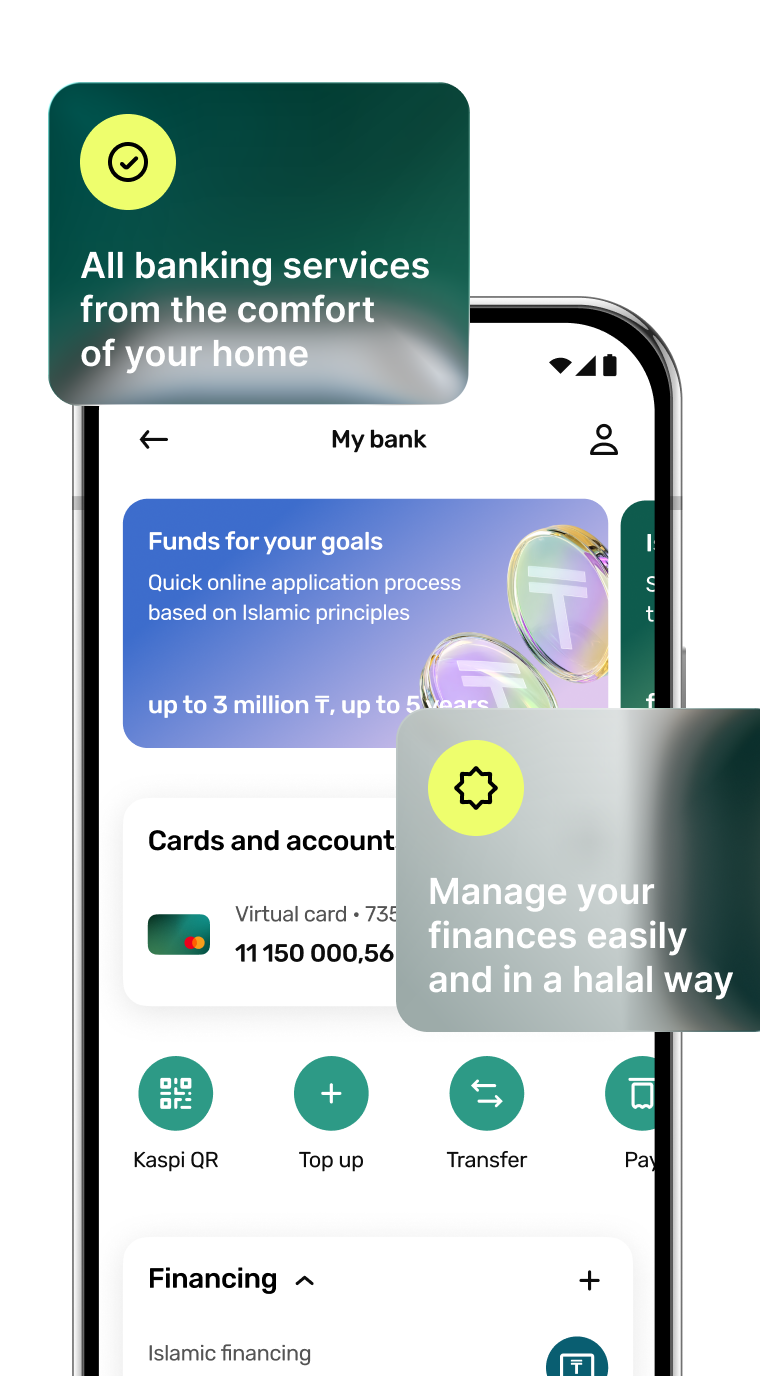

Install the mobile app

All ZAMAN BANK products in one place

Enter your details

to calculate your retur

Install the mobile app

All ZAMAN BANK products in one place

Earn

up to 15,000 ₸

for each friend

the answer to your question, please contact customer service

Islamic banking is a financial system based on the principles of Islamic law (Sharia).Unlike traditional banking, Islamic banking prohibits charging interest (riba), speculation and investing in prohibited (haram) industries - such as alcohol, gambling or weapons.

Islamic banking is regulated by the legislation of the Republic of Kazakhstan, as well as Sharia standards.

Islamic banks operate under a Sharia Supervisory Board (SSB), which ensures compliance with Islamic principles and excludes financing of prohibited sectors. The members of our Sharia Supervisory Board are:

Maksatbek Kairgaliev – Chairman of the Sharia Supervisory Board

Altaf Ahmad – member of the Sharia Supervisory Board

Adilbek Ryskulov – member of the Sharia Supervisory Board

Yes, you can use our products regardless of your religion.

Islamic banking is not about the client’s faith — it’s about principles: honesty, transparency, and respect. We do not charge interest (riba), we avoid hidden conditions, and we do not invest in questionable industries. All our financial decisions are based on the real economy, fair partnership, and trust.

Islamic banks do not offer traditional loans with interest, since interest (riba) is forbidden. Instead, Zaman Business uses alternative financing methods, such as the Murabaha commodity product currently available in the Bank.

1. Open the Zaman Business mobile app.

2. In the "Financing" section, click on the "Funds for your purposes" banner or the "Open product" button.

3. Enter the amount and term of financing.

4. Fill out the form and give your consent to data processing.

5. For faster approval, upload a 6-month statement from your Kaspi or Halyk card.

6. Wait for the bank's decision and verify your identity.

7. Sign the documents using your electronic digital signature (EDS).

After this, the funds will be credited to your account.

Yes, you can make an early repayment, either full or partial, through the Bank's Mobile App. The service is available daily from 09:00 to 21:00 Astana time.

For partial early repayment, the amount must be no less than two monthly payments

To submit an application, you only need your IIN. No additional documents are required.

There are no fees for submitting a financing application.

Applications are accepted from individuals who are citizens of the Republic of Kazakhstan, aged 21 up to retirement age.

ZAMAN BANK —

over 30 years of trust and stability

Digital Bank

mobile app