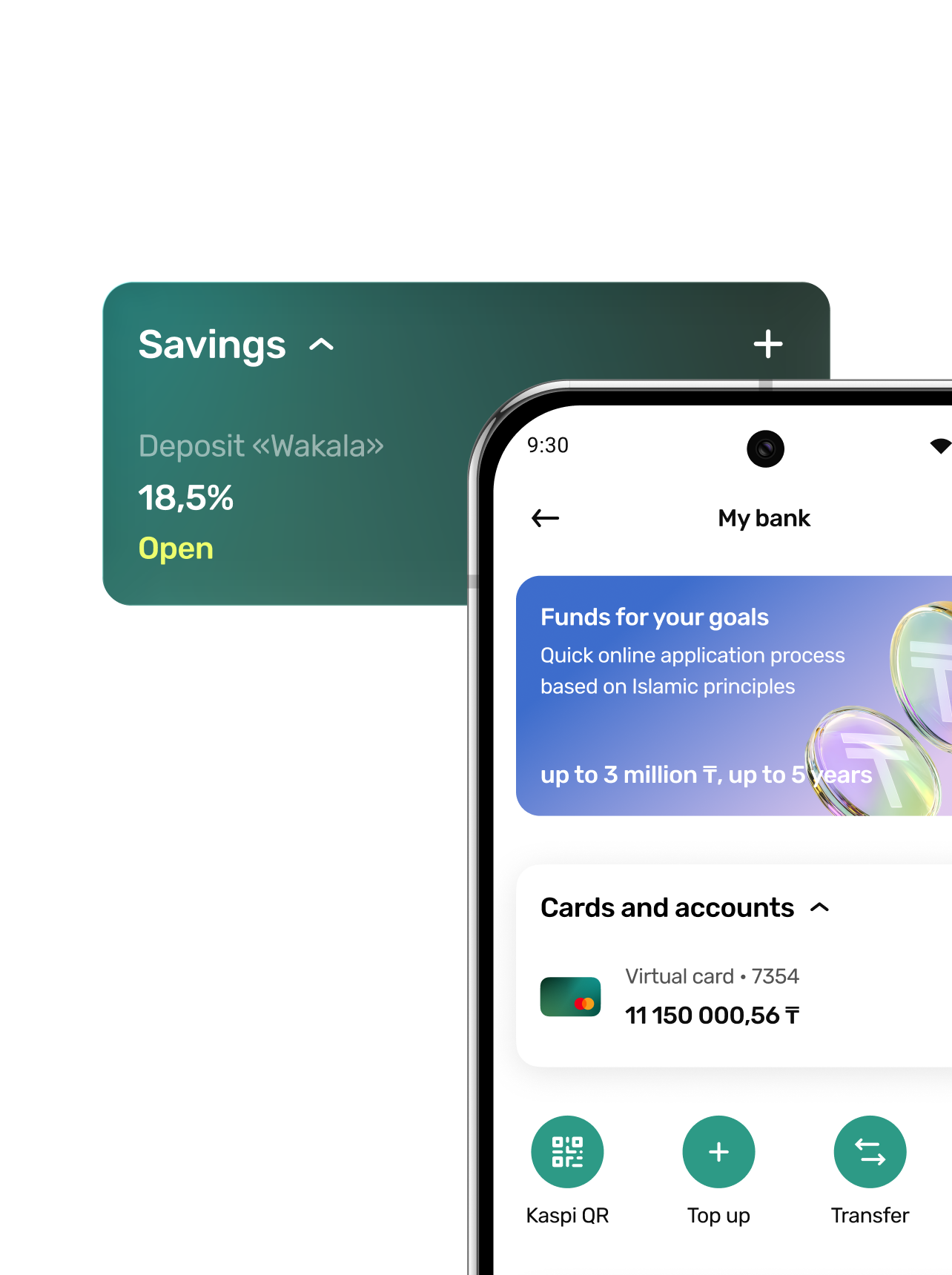

The first Islamic

digital bank

in Kazakhstan

The first Islamic

digital bank

in Kazakhstan

on your phone

ZAMAN BANK —

over 30 years of trust and stability

- Founded in Almaty as the private bank “Zaman”.

- It became one of the first banks in independent Kazakhstan.

- Following a change in shareholders, the bank moved its head office to Ekibastuz in the Pavlodar region.

- In its new location, it began actively working with clients and supporting the development of local businesses.

- The decision was made to transition to an Islamic model.

- The Islamic Corporation for the Development of the Private Sector (ICD) was engaged as a strategic partner.

- ZAMAN BANK, together with the consulting company Al Maali (UAE) and the law firm Zicolaw (Malaysia), developed the procedure and mechanism for transition into an Islamic bank.

- This step became a key stage in preparing for full compliance with Shariah principles.

- ZAMAN BANK initiated legislative amendments that enabled traditional banks to transition into Islamic banks.

- On July 13, 2016 the Bank received a Permit of the National Bank of the Republic of Kazakhstan to reorganize the Bank into an Islamic bank.

- The National Bank granted Zaman Bank an Islamic banking license. The Shariah Supervisory Board was established with the participation of the Shariyah Review Bureau.

- That same year, the Bank became a member of Bursa Malaysia, expanding its capabilities for developing Murabaha-based products.

- A representative office was opened at the Astana International Financial Centre (AIFC).

- This strengthened the Bank’s position in the global Islamic finance platform and broadened opportunities for international cooperation.

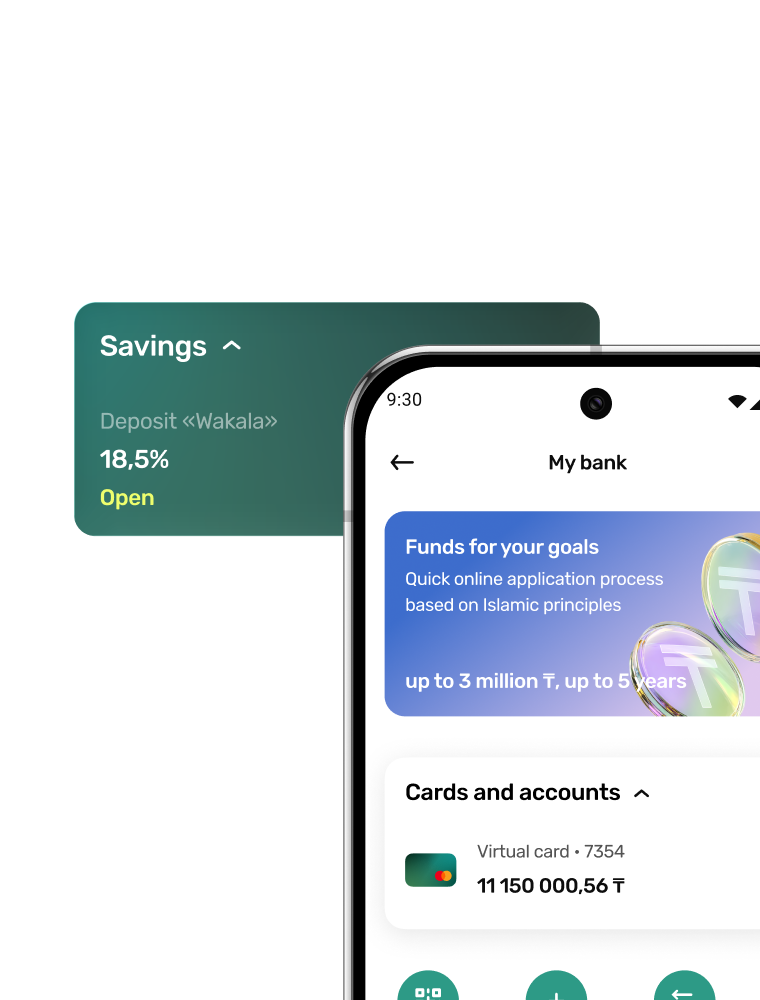

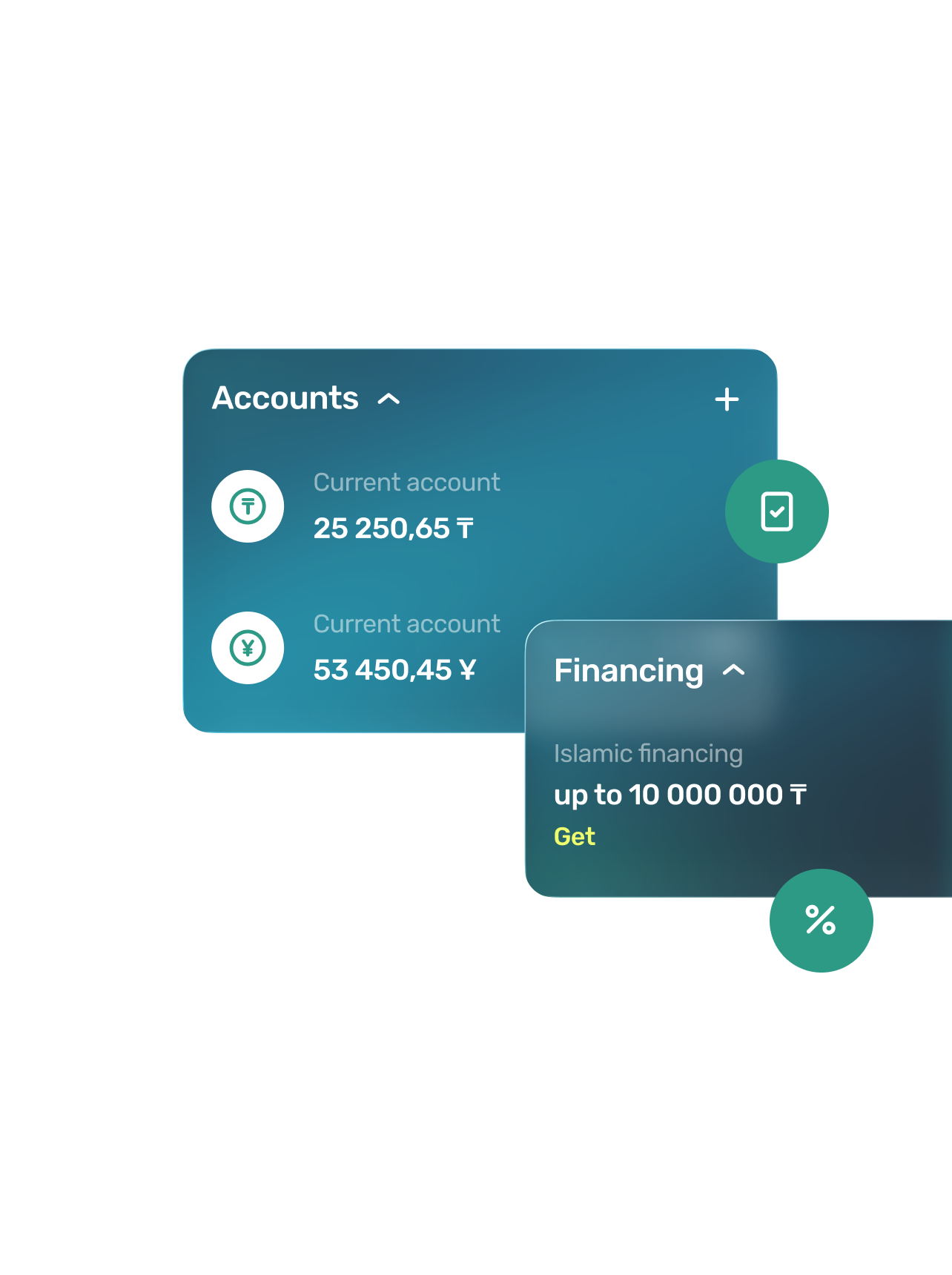

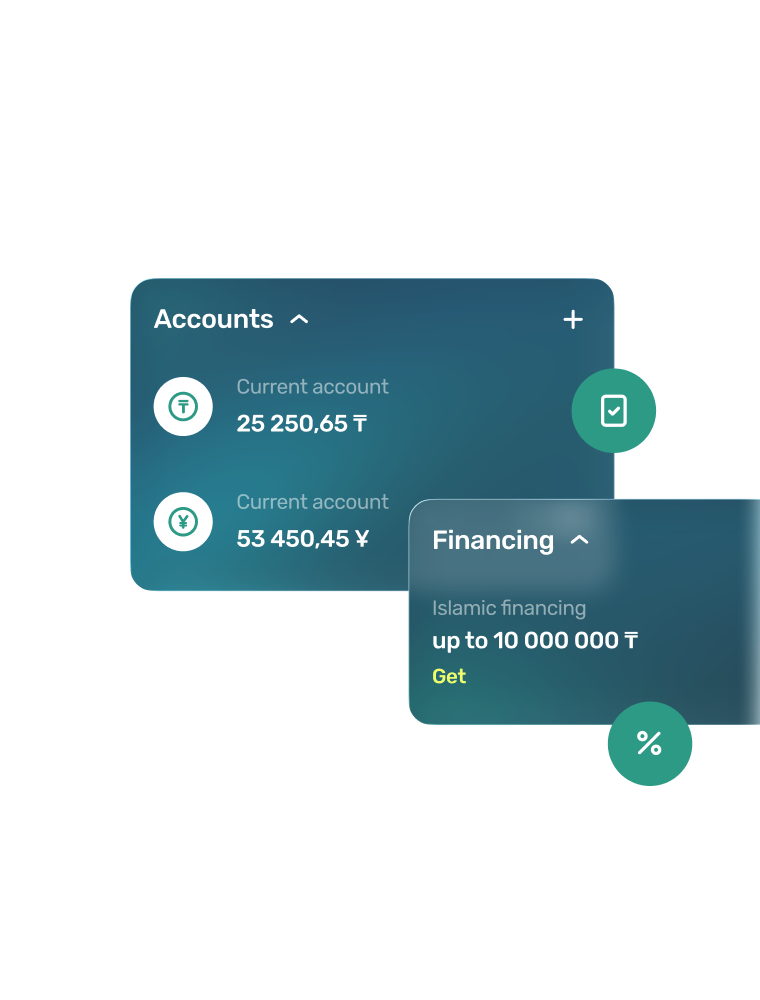

- ZAMAN BANK enters the market with products for both individuals and businesses, opening a new chapter in its history.

- The Bank expands its product line and strengthens its market position by introducing digital solutions in the field of Islamic finance.

Work experience:

She started her career in 2001 at Ekibastuzskaya GRES-2 JSC as a junior treasurer of the Treasury Department.

From 2007 to 2015, she worked at Zaman Bank JSC, where she worked her way up from the Chief Specialist of the Correspondent Relations Department of the International Department to the head of this department. Later, she held the position of Chief Specialist of the General Accounting Department of the Accounting and Statistics Department.

In the period from 2015 to 2018, she held the position of Financial Director of Zaman-Leasing LLP.

From December 2017 to February 2018, she also served as the Managing Director of Zaman-Bank Islamic Bank JSC.

From March 2018 to the present, he holds the position of Chairman of the Board of Zaman-Bank Islamic Bank JSC.

Since May 2021, he has been a member of the bank's Board of Directors.

Education:

2002 - 2007 — Oxford Brookes University, Budapest (Business and Languages)

2012 - 2013 — Al-Huda Center for Islamic Banking and Islamic Economics (Islamic Banking and Finance)

Work experience:

She started her career in 1995 in the Ekibastuz city Treasury Department (RCC of the National Bank, Budget Bank), where she worked her way up from an economist to a leading treasurer of the accounting and reporting department.

Since 1998, he has been working at Zaman-Bank Islamic Bank JSC. Over the years, she has held key management positions, including Head of the Financial Department – Treasury, Head of Risk Management, Head of the Department of Lending and Active-Passive Operations, as well as Compliance Controller.

Since 2007, he has been a member of the Bank's Management Board.

Education:

1992-1995 — Karaganda Accounting and Credit College of the Kazakh State Academy of Management (Banking Specialist);

1999 - 2002 — Karaganda Financial Institute (Banking)

Work experience:

He started his career in 2000 in the tax authorities of the city of Pavlodar. In 2001-2002, he worked in the branches of JSC Komirbank and JSC BankTuranAlem in the field of information technology and retail business.

Since February 2002, he joined JSC Zaman-Bank, where he held the positions of Chief Specialist of the General Accounting Department, Head of the Accounting and Statistics Department, Deputy Chairman of the Management Board, First Deputy Chairman of the Management Board, Financial Director – Chief Accountant (CFO).

Since April 2025, he has been Deputy Chairman of the Board of Zaman-Bank Islamic Bank JSC.

Education:

1995 - 1999 — Pavlodar University (Accounting and Finance, Taxes and Taxation);

2009 - 2010 — Al-Huda Center for Islamic Banking and Islamic Economics (Islamic Banking and Finance);

2016-2017 — MBA in Islamic Banking and Finance, Al-Huda Center for Islamic Banking and Islamic Economics

Financial Indicators

$5 billion

in 2024

4.1 billion ₸

as of July 1, 2025

Deposit growth

Individuals deposits increased by 169% up to 346.6 million ₸.